Millennials are on a home buying streak.

Data from Realtor.com shows Millennials made up a whopping 46% of all mortgage originations in September—up from 43% a year before.1 With interest rates low and incomes up, it seems that many have decided that it’s a good time to make their move.

Unfortunately, many people who would like to buy their first home are facing real challenges. Low inventory has caused starter-home prices to skyrocket in some markets. But even in places where homes remain more affordable, many first-time buyers are in a tight spot. They continue to pay monthly rent to a landlord; they may be saddled with student loan debt; and they may have little or no savings for a down payment on a house.

It can easily take three years for a cash-strapped Millennial to save up enough money for a down payment.2 So, are these potential buyers motivated enough to save for three years? Surprisingly, Millennials rank homeownership as one of their top goals in life—higher than even marrying or having kids.3 And yes, they are using their own savings to fund the majority of their down payment.4

An uphill battle

Let’s face it, it’s hard to save money, especially when you’re on a tight budget. Like achieving other difficult goals, it takes willpower and sustained motivation. You need to stay focused on your goal, monitor your progress and see that it’s working. And it really helps to get encouragement and stay excited about the end result. When it comes to saving for a down payment on a house, Bankrate recommends that you set up a dedicated savings account.5

An app for that

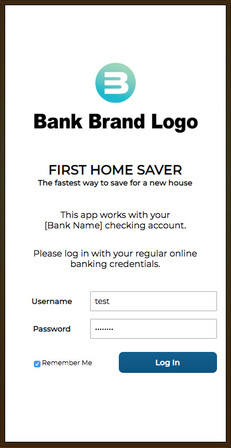

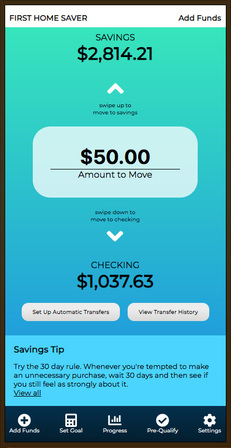

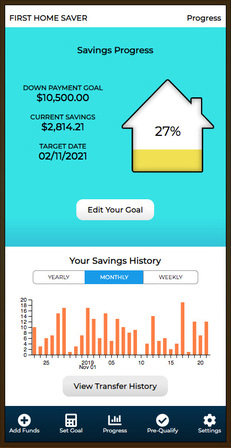

Introducing the First Home Saver app. It’s a feature-rich mobile savings account that has just one goal. It’s designed to keep you focused, engaged and encouraged, as day by day, you get closer to buying your first home.

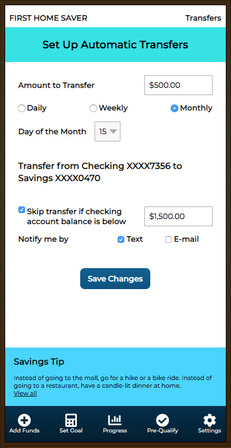

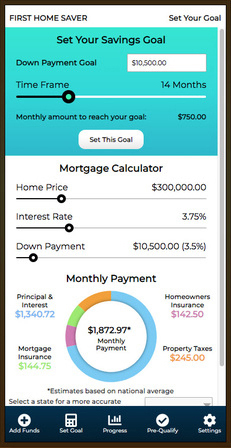

The app’s features include:

- Open a new online savings account with your bank.

- Set your goal and time frame with the help of a built-in mortgage calculator.

- Slide money from your checking to savings as you make daily choices to save money.

- Slide money back to your checking account whenever you really need it.

- Set up automatic transfers, daily, weekly, or monthly.

- Receive savings tips, mortgage tips and home buying tips.

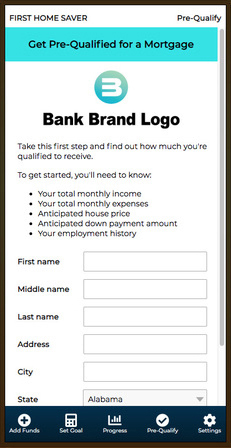

- Get pre-qualified for a mortgage through your bank.

- View your progress and watch your savings grow.

For banks

The First Home Saver app will allow banks and mortgage companies to rapidly upgrade their technology offerings to meet the expectations of tech-savvy Millennials who are planning to buy their first home.

Previously, banks rarely knew if one of their customers was saving up to buy a house. Now they can see when a customer downloads and uses the First Home Saver app. The bank can connect with those customers to offer mortgage products and other services, building stronger relationships.

A new TransUnion analysis projected that at least 8.3 million first-time homebuyers will enter the mortgage market between 2020 and 2022.6 That number could climb to as high as 9.2 million if economic growth exceeds expectations, or even higher if student loan forgiveness programs are enacted. The time is right for the First Home Saver app.

Community and social good

The First Home Saver app is also good for communities. Studies have shown that home ownership helps build community pride, which in turn provides a safer environment for children and families.

The First Home Saver app can be distributed as a free tool to potential home buyers in areas that are underserved by traditional banks and mortgage companies. The app can be customized to work with first-time buyer assistance programs or community housing organizations.

App Screenshots

Our Team

Our team includes developers and designers who would like to make a positive difference through creating innovative experiences that improve people's lives.

The First Home Saver App is a win for communities, a win for banks, and a win for all those dreaming of owning their first home.

1, 3. Forbes.com, November 15, 2019, "2020 Real Estate Outlook: Expert Predictions For Mortgage Rates, Home Prices, Tech And More"

2, 4, 5. Bankrate.com, September 11, 2019, "Survey: Nearly Half of Millennials Cite Living Costs as a Key Barrier to Homeownership"

6. TransUnion.com, October 29, 2019, "Housing Market to Receive Boost as Number of First-Time Homebuyers Expected to Rise"